of Your Family

After Your Passing

Protect your loved ones from financial hardship when you are

no longer around. Offset out-of-pocket expenses by securing

yourself a life insurance policy and preparing for your

family’s financial future.

We Believe In

Putting You

FIRST!

Starting at just GHC5 per month to ensure your retirement.

⚫ Apply over the phone – in the comfort of your home!

⚫ Competitive rates & coverage

Insurance Quote

your needs and provide the security you want.

By answering a few simple health questions, you can get

a quote quickly and easily. Plus, you can buy a policy

online if you qualify.

You Want The Best

For Your Child’s

Education

with cash benefits that are aligned to your

child’s education expenses.

--Financial Independence

We’re all better off when we’re there for each other.

Life insurance can help your loved ones:

-

Create generational wealth

-

Guarantees continuity of life

-

Replace lost income or the value of

your time (e.g., stay-at-home spouse)

-

Pay off debt

-

Replaces the bread winner's income

-

Cover the rising cost of funeral expenses

Term life insurance gives your family protection for a range of time—anywhere from 15 to 40 years. If you pass on, your beneficiaries receive a tax-free monetary death benefit. This can help them pay for things like a mortgage, education or other everyday expenses like groceries or childcare.

-

Coverage amount (i.e., death benefit):

GHC 30,000- GHC 2,500,000 -

Length of coverage: 15 to 40 yearsInsurance

-

Cost (premium): Less that GHC 5.00 per day

-

Age limits at issue: 25 to 49

-

Add-ons: An added policy

for children (Child rider), accidental

death benefit, Wavier of Premium

and Loyalty bonus (15%)

--- Financial Independence ---

OUR UNIQUE PRODUCTS

OUR “BUY TERM AND INVEST IN MUTUAL FUNDS” AND “EDUCATION POLICY,” SAFEGUARD THE INCOME OF BREADWINNERS AND ENSURE ADEQUATE TERTIARY EDUCATION FOR YOUR WARD(S)

Due to the loss of the breadwinner, many families have suffered financial strain. It is therefore imperative for breadwinners to make provision for the replacement of their income to ensure continuity of life and peace of mind for the surviving family.

Our “Buy Term and Invest in Mutual Funds” product, provides families with an adequate insurance cover ( 3-12 ) years of annual income to protect the family in the event of premature death.

Our research has revealed that most parents struggle to handle the educational expenses of their ward at the tertiary level, due to stagnation in their career or job uncertainty. While some are given early retirement packages, some also experience job losses at that crucial stage of their child/ward’s education. First Insurance Education policy is structured to pay for the educational expenses of your Child/Ward at their preferred University.

Read MoreOur Journey through time

Our Journey through time.

--Financial Independence

This is why we

stand tall!

Participate and you will be rewarded. That's how simple it is.

Get In Touch

Easy Way to Get Our Unique

Insurance Products?

Option 1

Fill out the form by providing all requested information and that's it! We will get back to you within 24 hours.

Request a Quote

Option 2

Fill out the form by providing all requested information and that's it! An advisor will get back to you immediately.

Contact Us

Option 3

Fill out the form by providing all requested information and that's it! An advisor will get back to you immediately.

Request a Call backPopular Clients

Our Trusted Partners

Sed ut perspiciatis unde omnis iste natusey voluptatem accusantium dolore

Latest News & Blog

Read Our Latest Articles

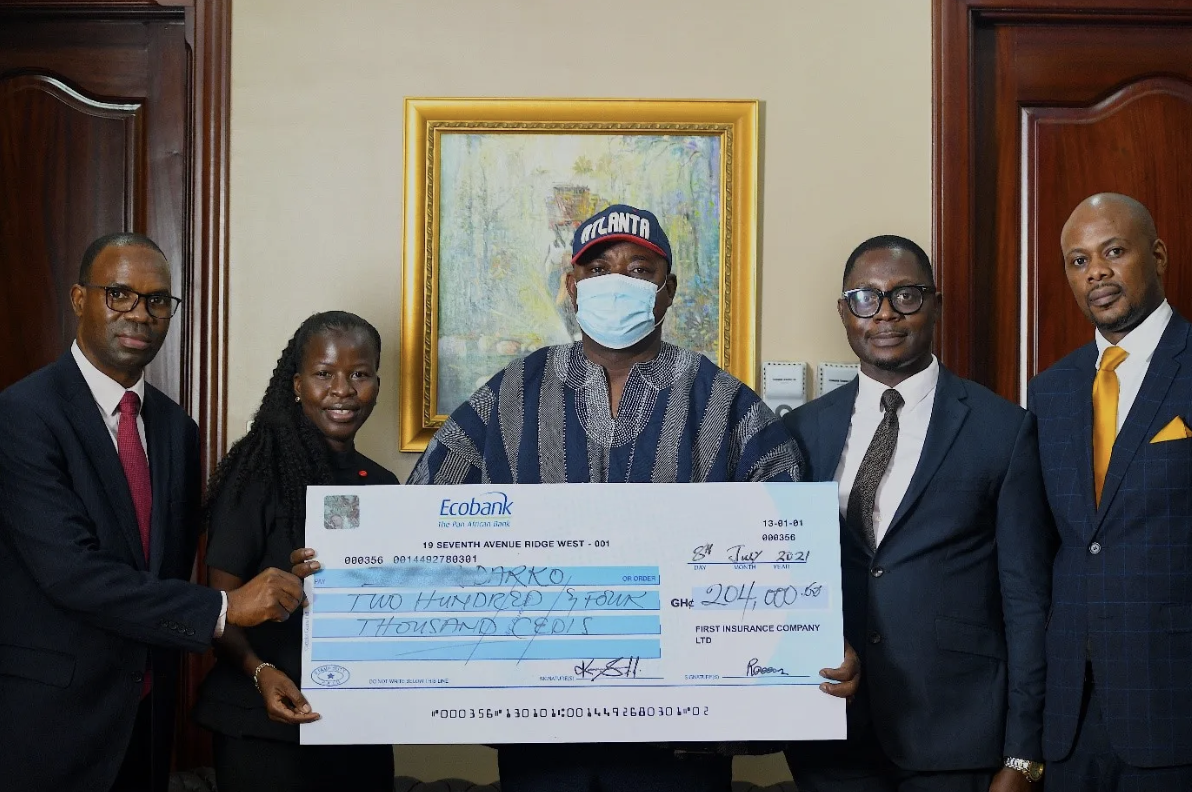

First Insurance pays over ₵150k as death claim to beneficiary.

First Insurance Company presented a check for GH¢150,272 on behalf…

The First Insurance Company (FIC) Limited on August 29, presented a cheque for GH¢40,000 to the family of a deceased client at Santa Marie in Accra.

Sed ut perspiciatis unde omnis iste natus error sit voluptatem…