- Home

- Products

First Insurance Company Limited has uniquely designed two products “Buy Term and Invest in Mutual Funds” and “Education Policy” aimed at protecting the breadwinner’s income and also ensuring that the tertiary education needs of your child/ward are adequately catered for.

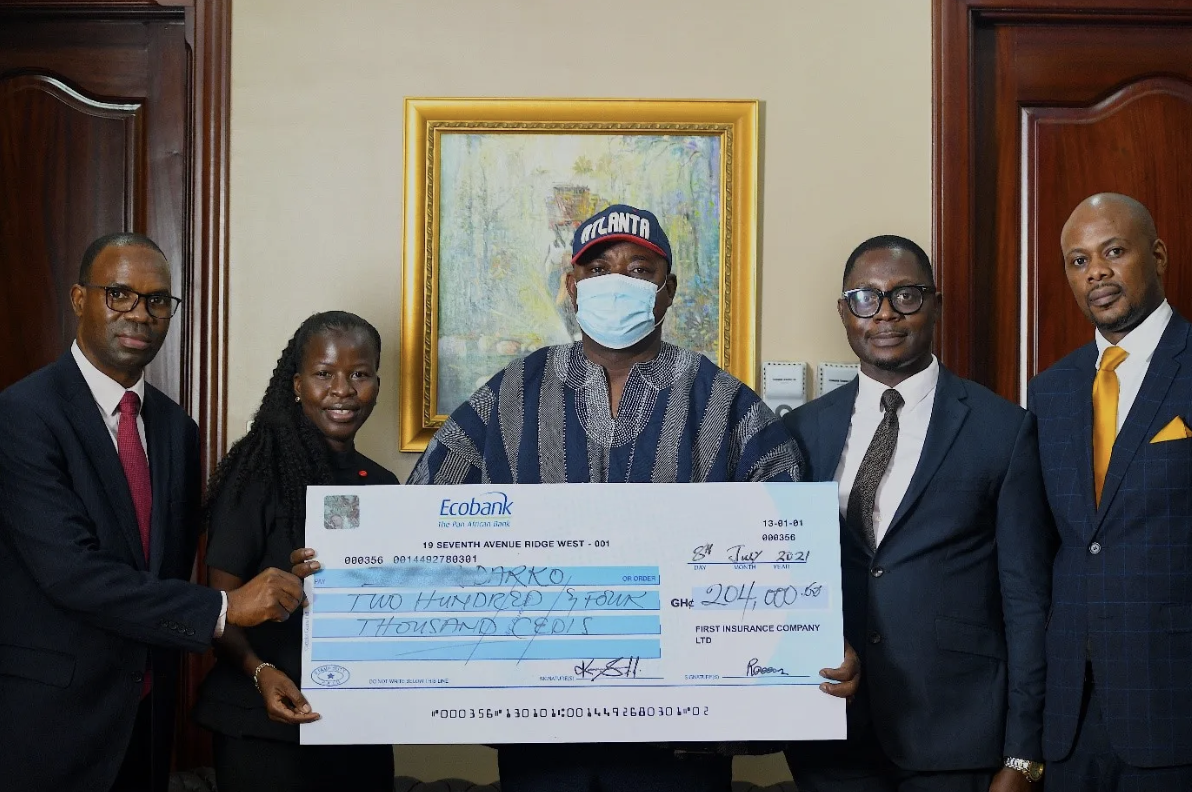

First Insurance is firmly committed to professional policy administration and prompt payment of legitimate claims for maximum satisfaction and peace of mind of all our clients.

FINANCIAL INDEPENDENCE

Buy Term and Invest in Mutual Funds

We are all growing ever older. Although no one knows what the future holds, we all know we want to lead a self-determined life into old age. This is where First Insurance assists its customers, with our comprehensive, family-centred Term Insurance Product that replaces the policyholder’s income in the event of premature death during the policy term.

A named child

INSURE YOUR WARDS EDUCATION

EDUCATION POLICY

Our research has revealed that most parents struggle to handle the educational expenses of their ward at the tertiary level, due to stagnation in their career or job uncertainty.

While some are given early retirement packages, some also experience job losses at that crucial stage of their child/ward’s education.

Our Education policy is structured to pay for the educational expenses of your Child/Ward at their preferred university or College. If death occurs during the term of the Policy, the sum assured is paid into the child’s Mutual Fund Account.